Resilient Ravi

Relationship Manager, Bengaluru | 6+ Years of Experience in Sales & Lending | Commerce Graduate

Male | 30 years | Married

"Targets come and go, but relationships stay. I just wish things were faster, smoother, and less stressful."

👤 About Ravi

Ravi is a dedicated Relationship Manager who hustles to meet monthly targets while balancing personal responsibilities.

Living in Bengaluru for work, he visits his wife, daughters, and elderly parents in Gulbarga every month. Despite the pressure of closures,

manual paperwork, and high ROI hurdles, he remains jovial and energetic, though he hides the stress. Not tech-savvy, he relies on intuition,

people skills, and his manager’s support to navigate tough cases. He dreams of becoming a Branch Manager but struggles with manual processes,

last-minute dropouts, and intense performance pressure.

🎯 Goals & Motivations

- ✅ Career Growth - Wants to be a Branch Manager

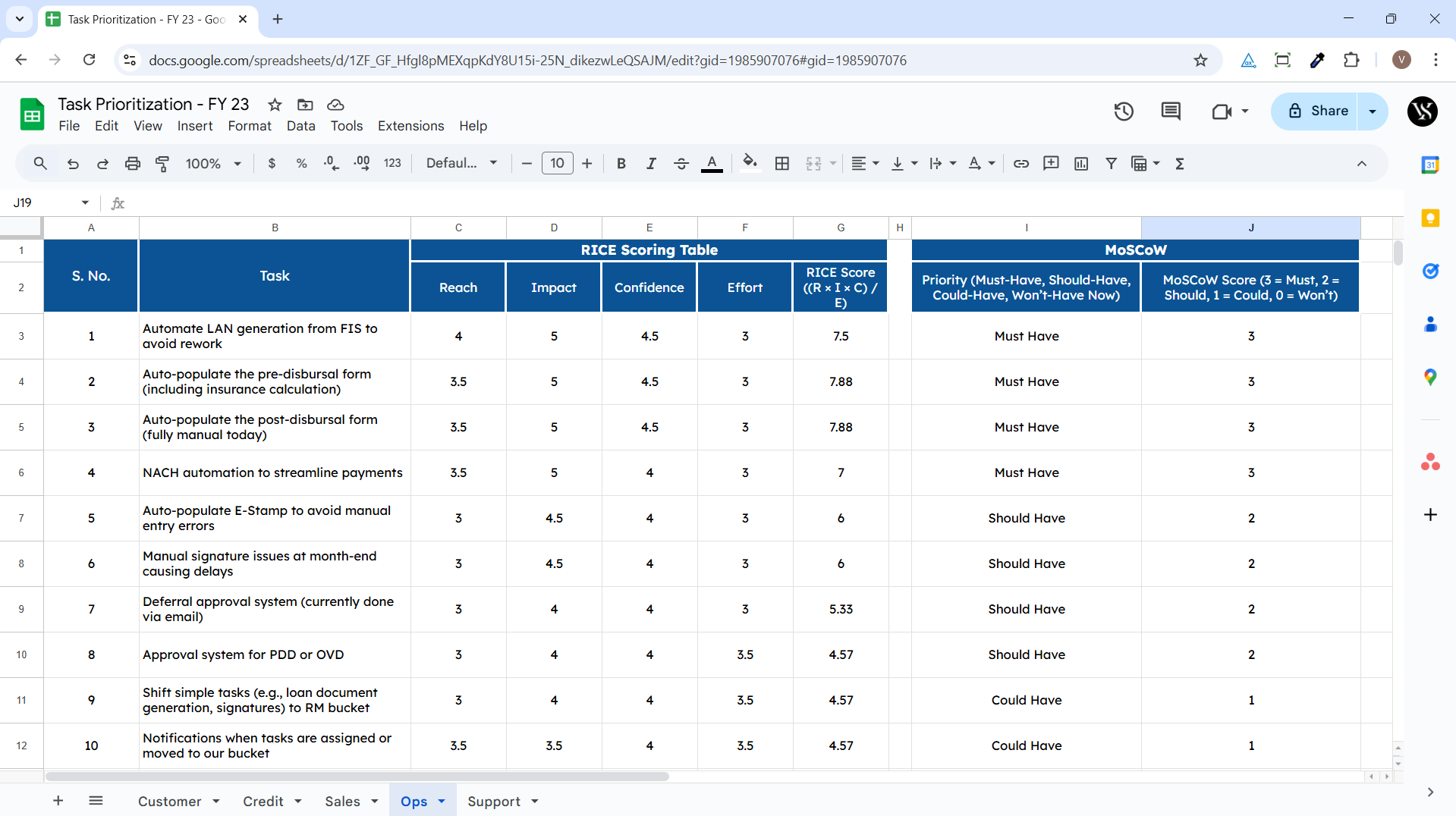

- ✅ Higher Conversions - Wishes for automation to reduce manual work

- ✅ Recognition - Aims to top the branch rankings every month

- ✅ Work-Life Balance - Wants less month-end stress

🔍 Needs & Expectations

- 🔹 Automation - Reduce manual data entry & paperwork

- 🔹 Simplified Processes - Quicker approvals & loan disbursals

- 🔹 Support for Sales Pitch - Clear ROI breakdown & selling points

- 🔹 Confidence Boost - Better understanding of credit criteria to fight for cases

- 🔹 Branch Manager’s Help - Easier ways to escalate tricky cases

💡 Preferred Tools & Technology

- 📲 WhatsApp & Calls - Primary mode of communication with DSAs & customers

- 📲 Basic Banking Apps - Used for transactions & customer insights

- 📲 Social Media (YouTube, FB, Insta) - For leisure & occasional learning

- 📂 Offline Documentation - Still depends on physical forms & signatures

😤 Pain Points & Frustrations

- 🚨 Month-End Chaos - Works late nights chasing closures and signatures

- 🚨 Manual Data Entry - Cumbersome form-filling and physical paperwork slows him down

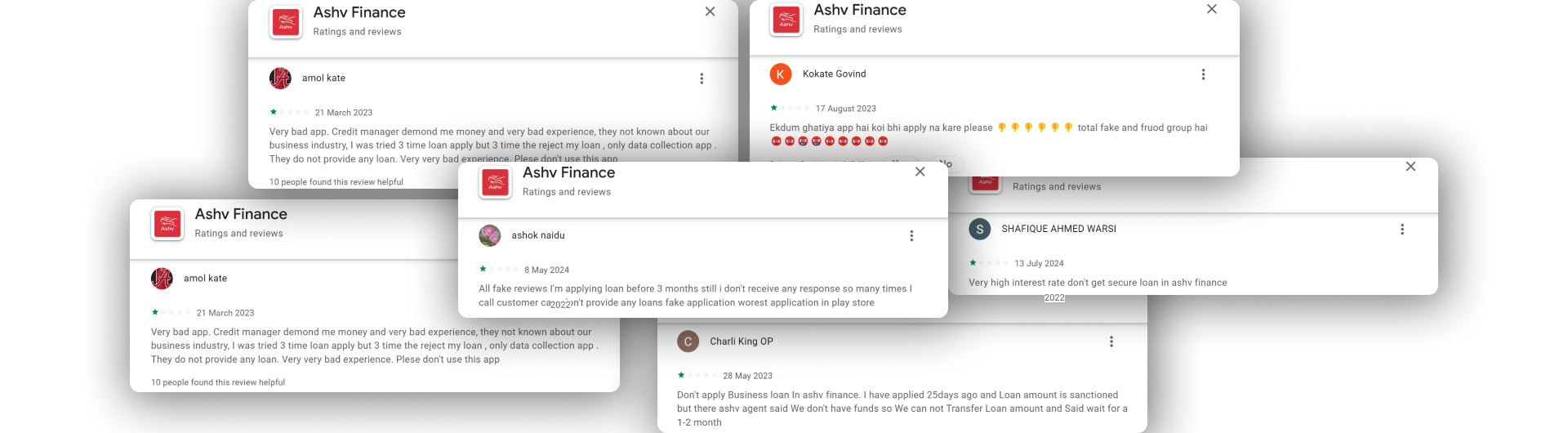

- 🚨 Customer Hesitation on ROI - Struggles to convince MSMEs due to high interest rates

- 🚨 Target Pressure - Faces scolding from Branch Manager & Regional Head if numbers are missed

- 🚨 Lack of Automation - Wishes the loan process was more digital & efficient

- 🚨 Confidence Gap in Credit Discussions - Needs manager’s help to push tricky cases

- 🚨 Last-Minute Case Dropouts - Customers backing out impacts his credibility & commissions

😊 What Delights Him?

- 🌟 Topping the Leaderboard - Feels motivated & recognized when his name is on top

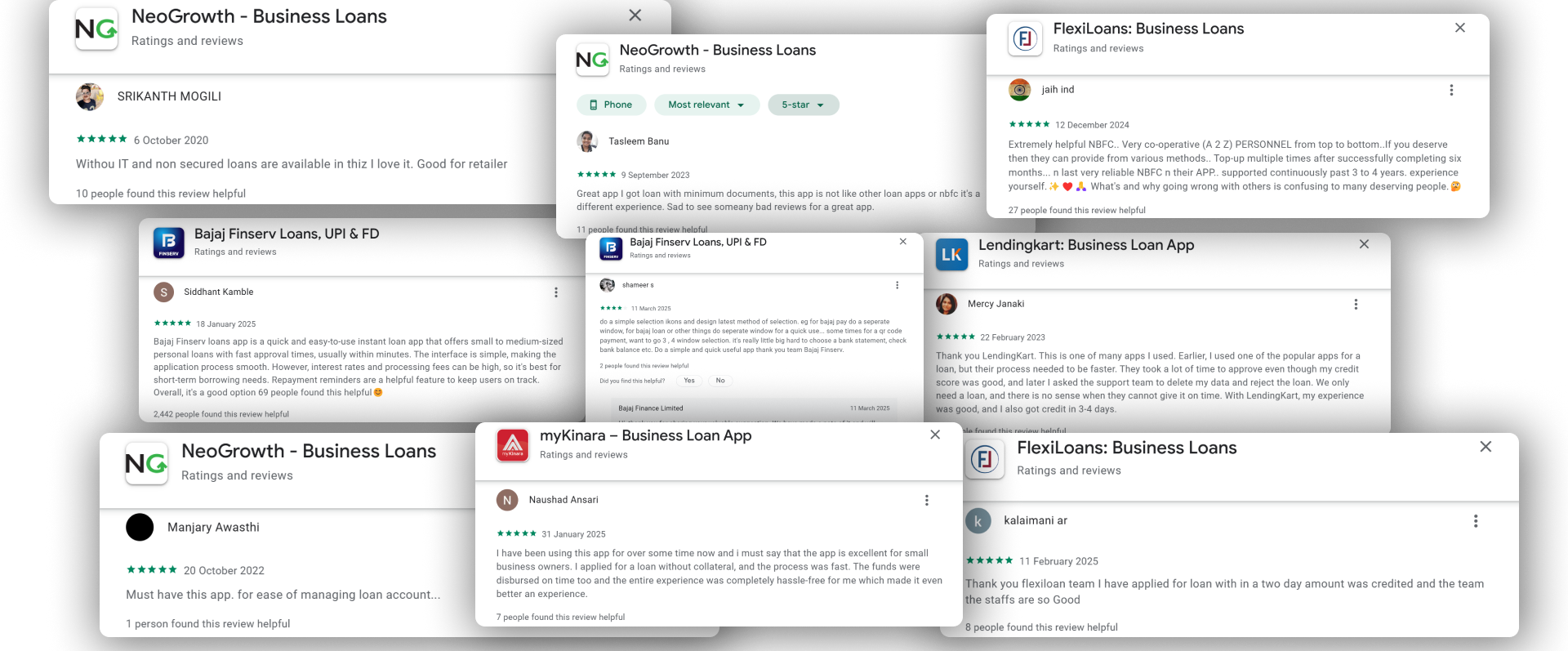

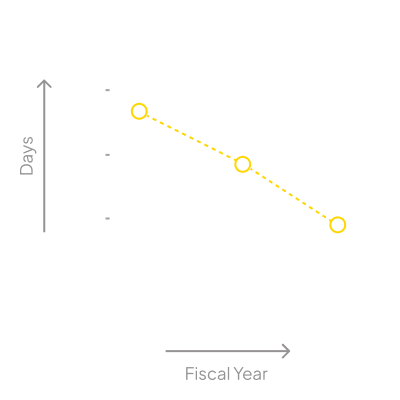

- 🌟 Quick Loan Approvals - Gets excited when cases are approved fast without friction

- 🌟 Happy Customers - A smooth closure with a satisfied customer makes his day

- 🌟 Branch Manager’s Support - Feels confident when his manager backs his case

- 🌟 Surpassing Targets - Loves getting rewarded for exceeding expectations

- 🌟 Festive Incentives & Bonuses - Enjoys extra perks during peak business seasons

📌 Key Design Considerations

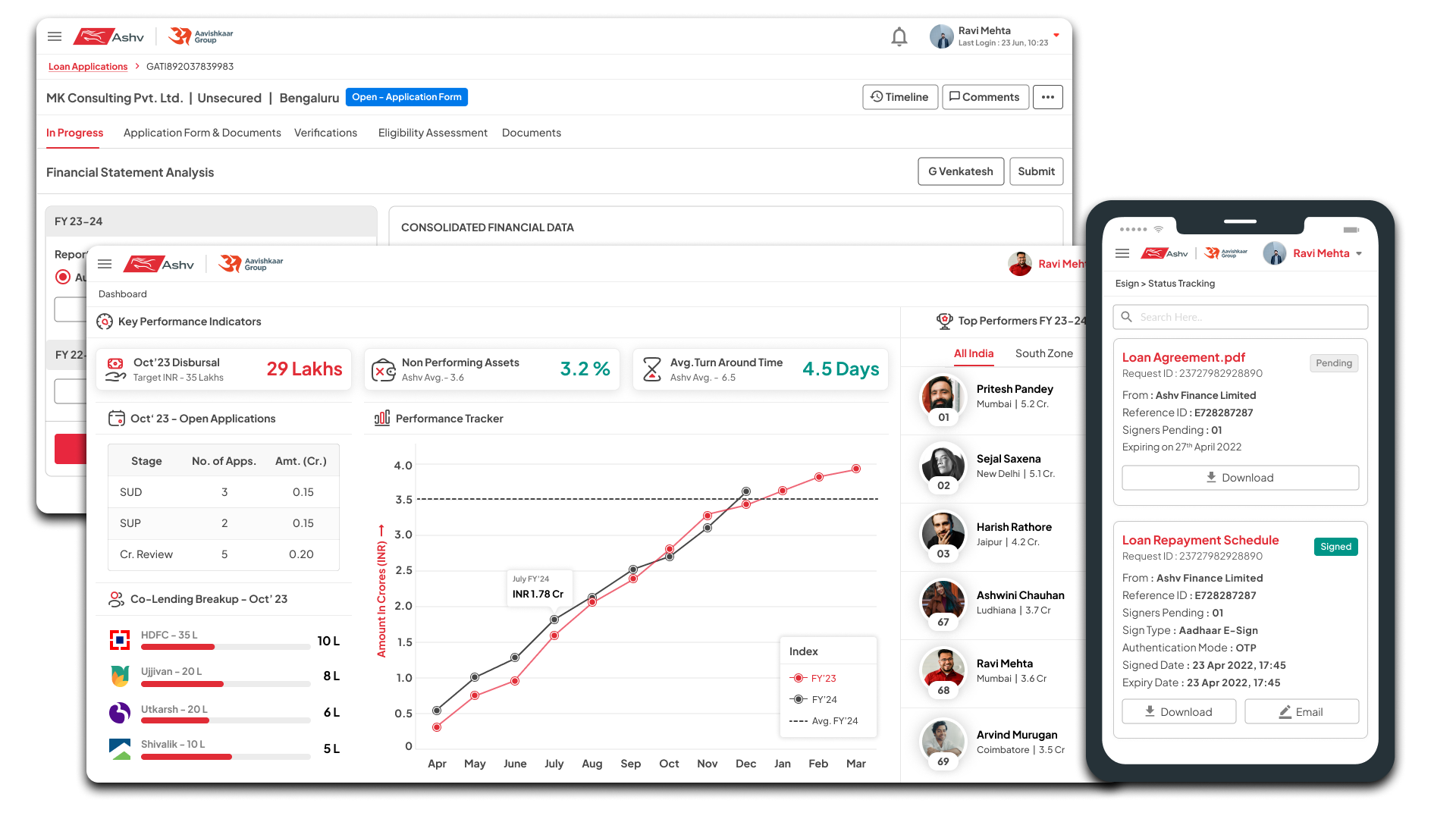

- 🎯 Mobile-First Design - Should work seamlessly on a smartphone

- 🚀 Fast & Simple UI - Minimize data entry, reduce friction in processes

- 📢 Guided Sales Support - Provide talking points & ROI justifications

- 🔄 Offline Sync & Auto-Save- Helps when network issues arise

- 🛠️ Role-Based Access - Easy escalation workflows for approvals

- 📈 Gamification & Leaderboards- Motivates to top the charts

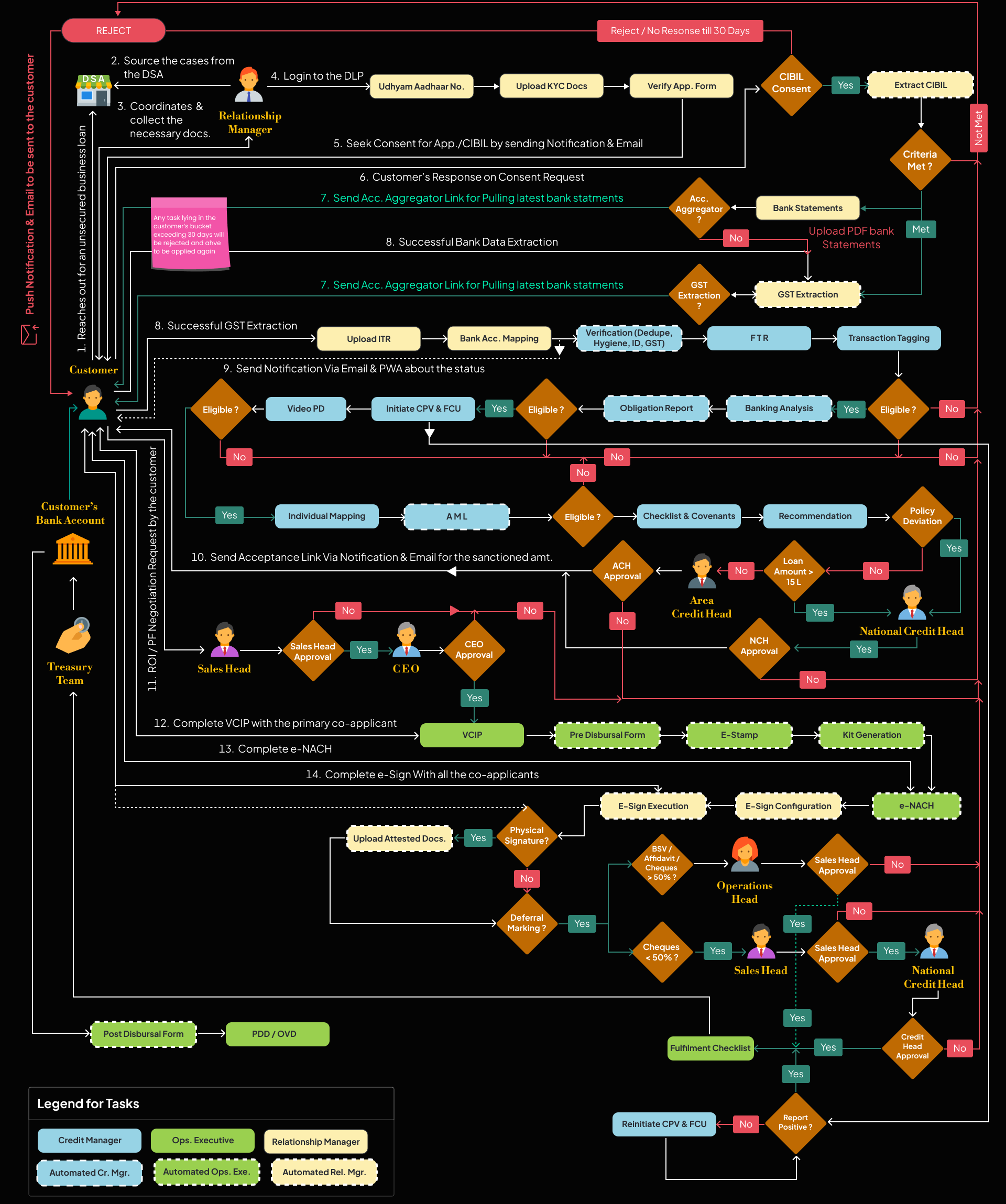

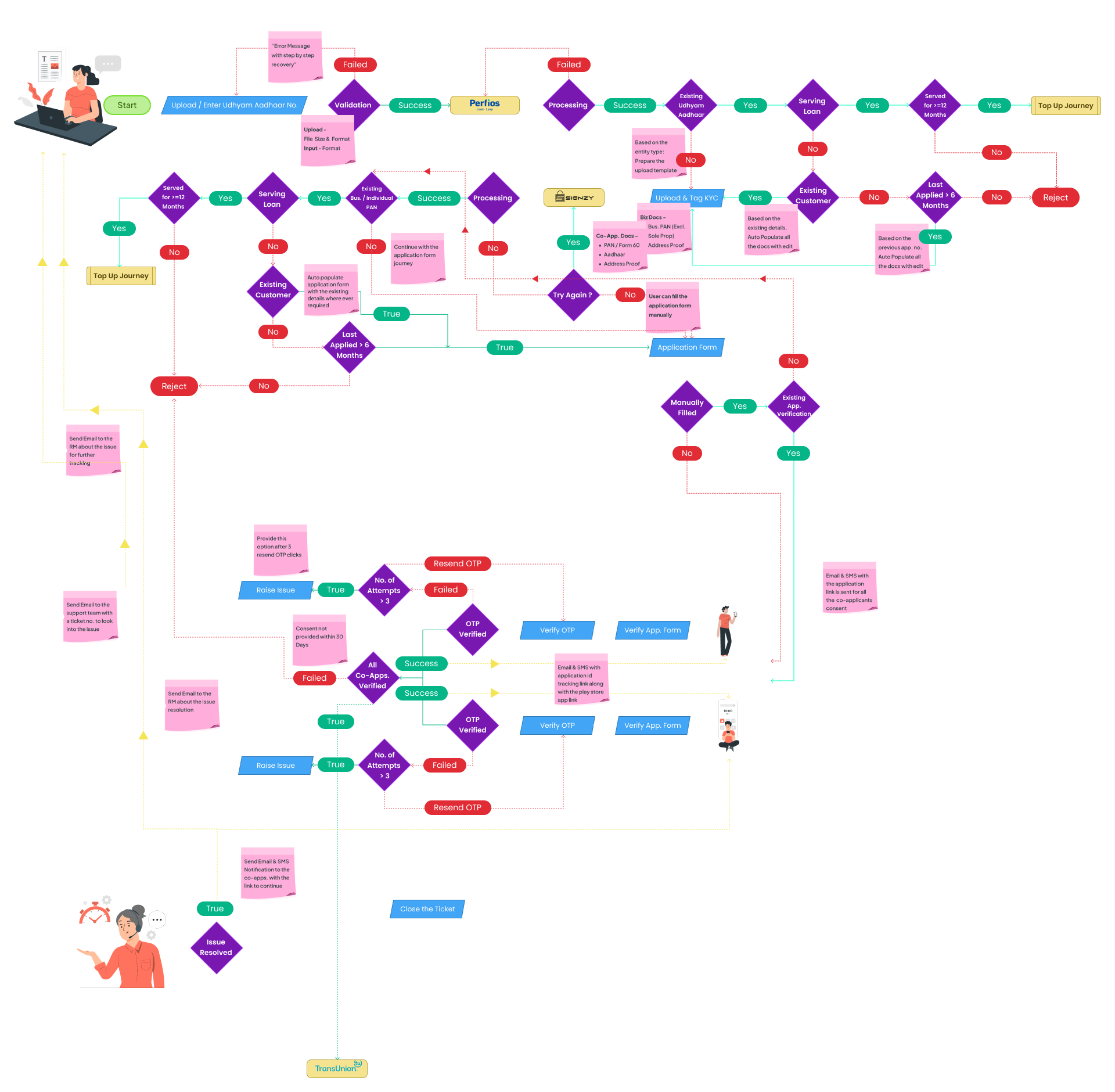

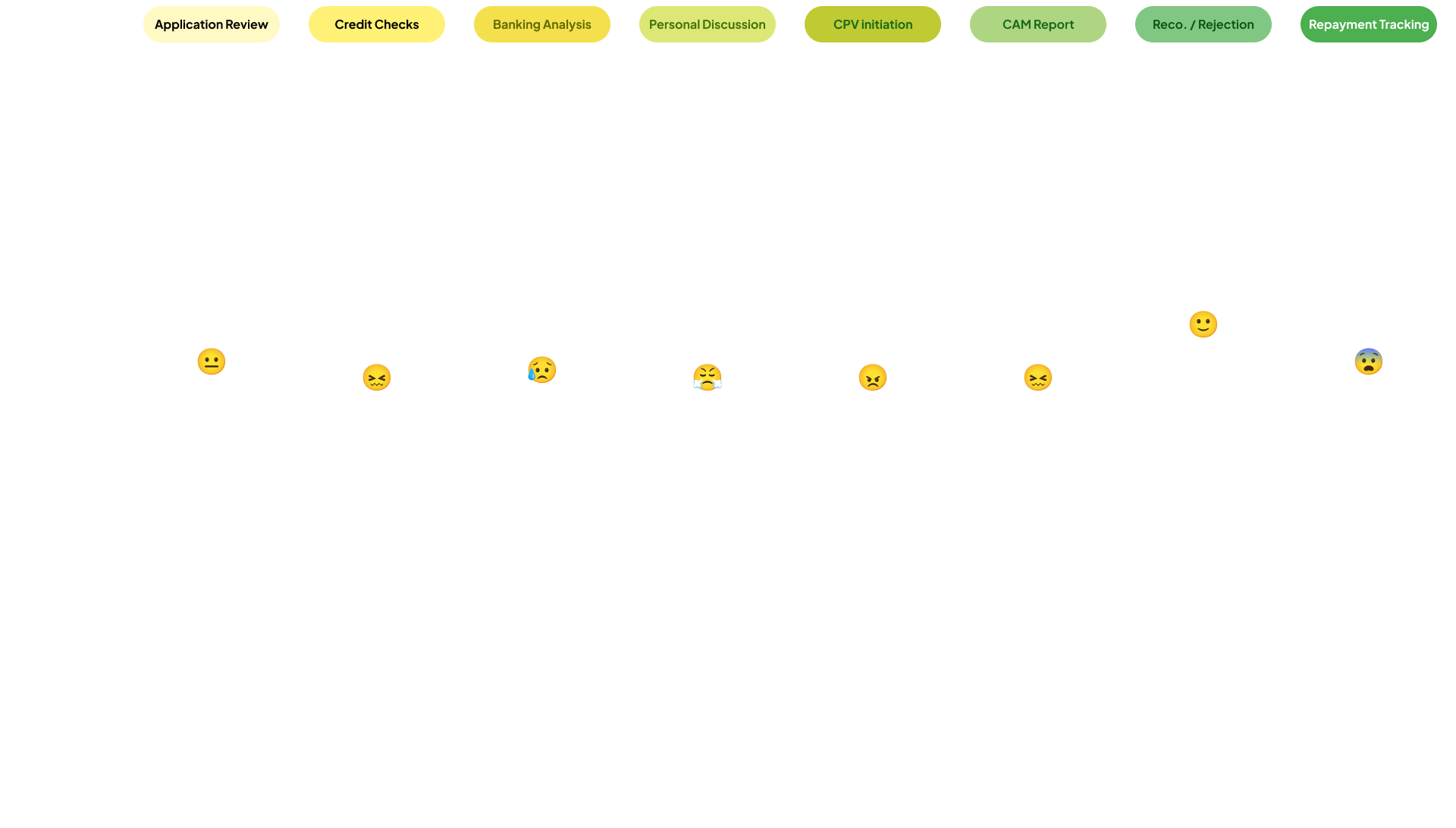

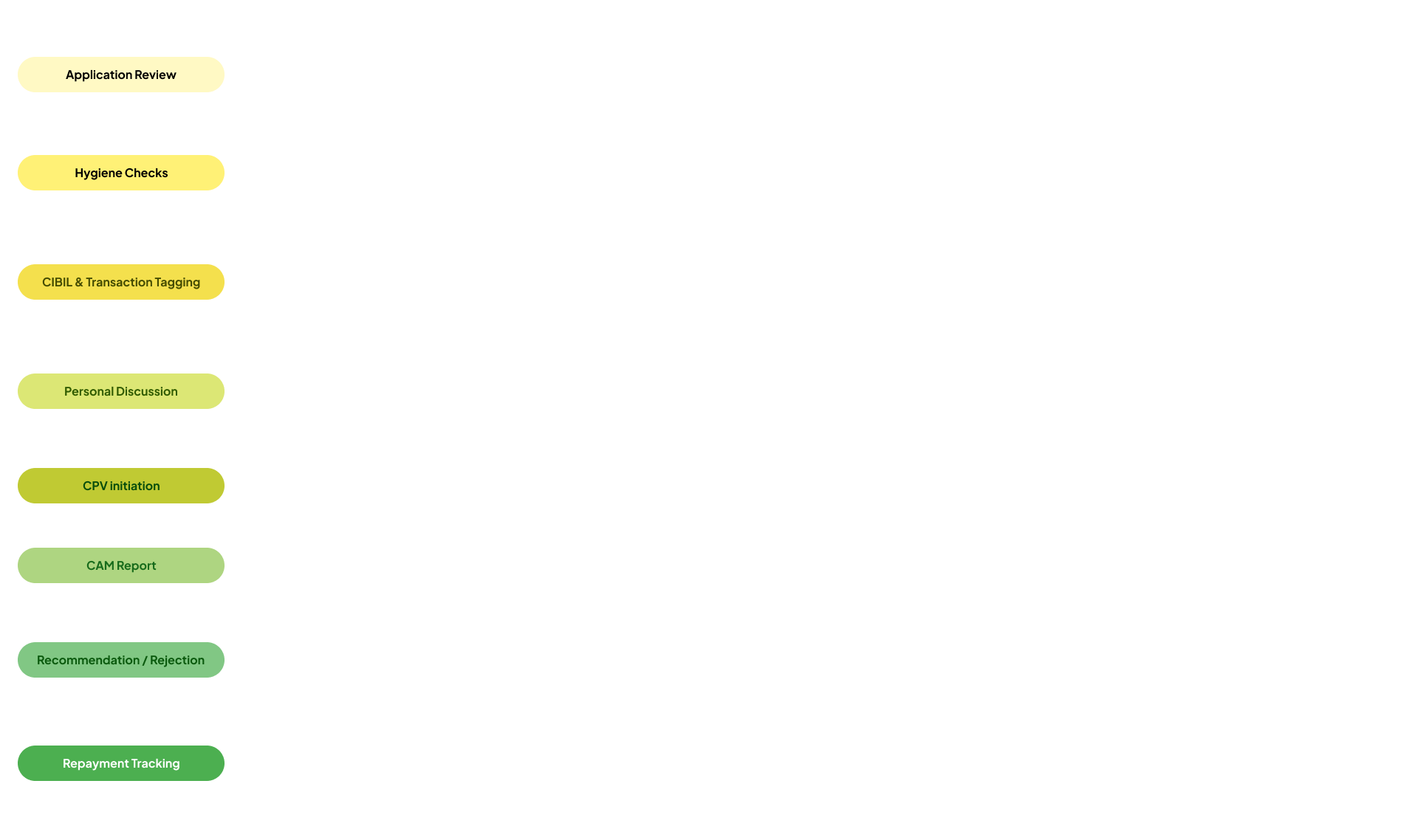

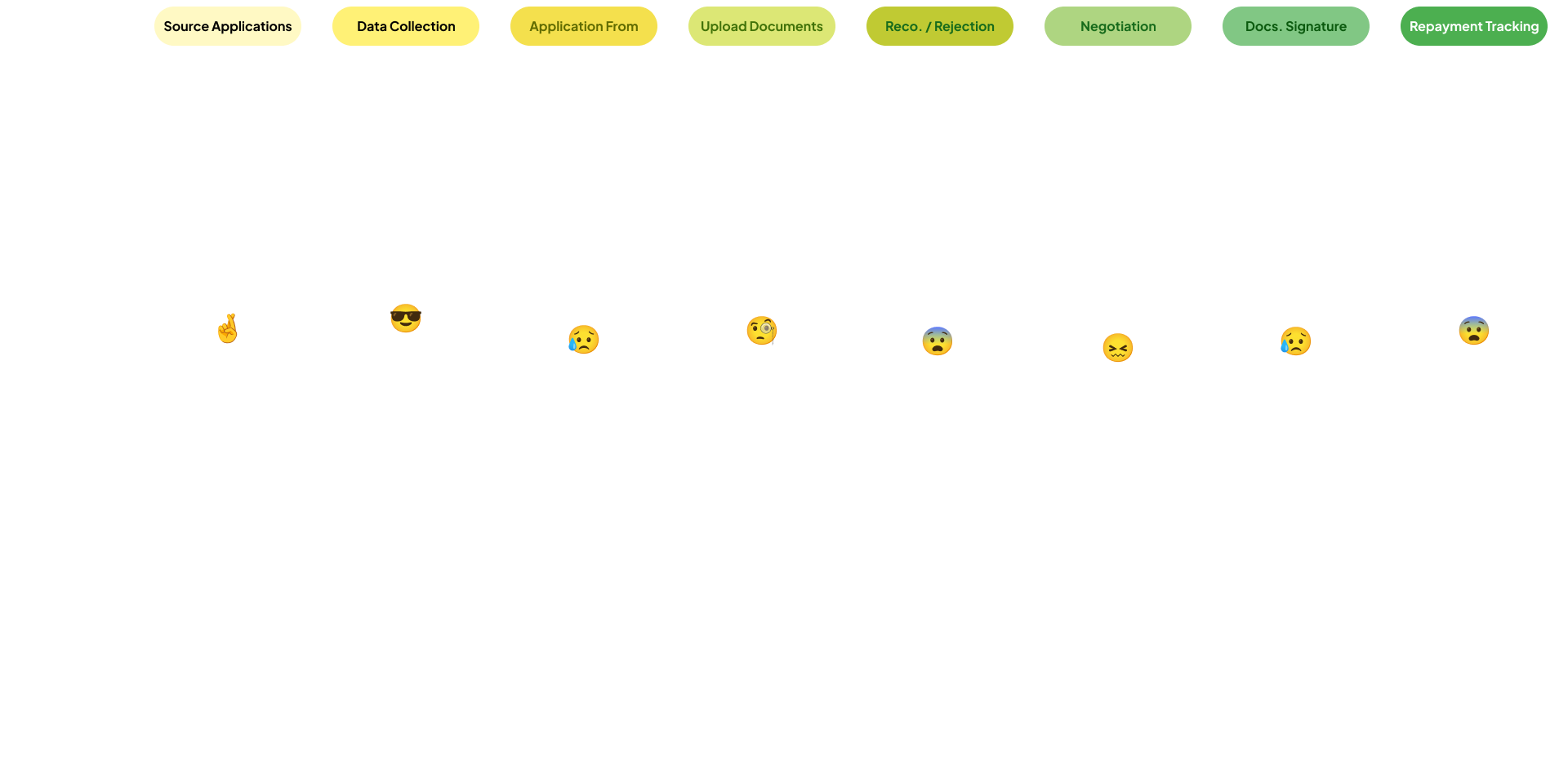

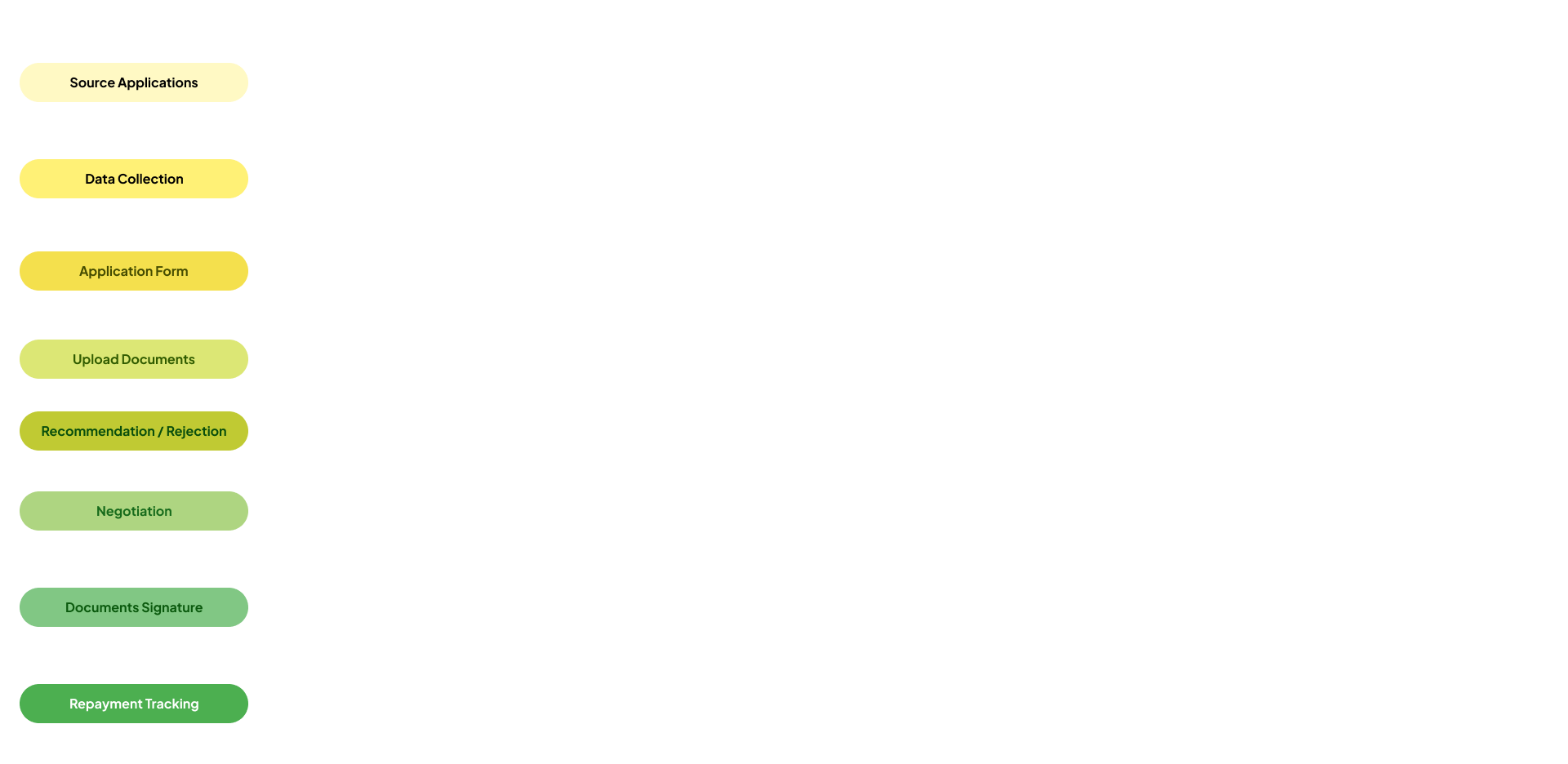

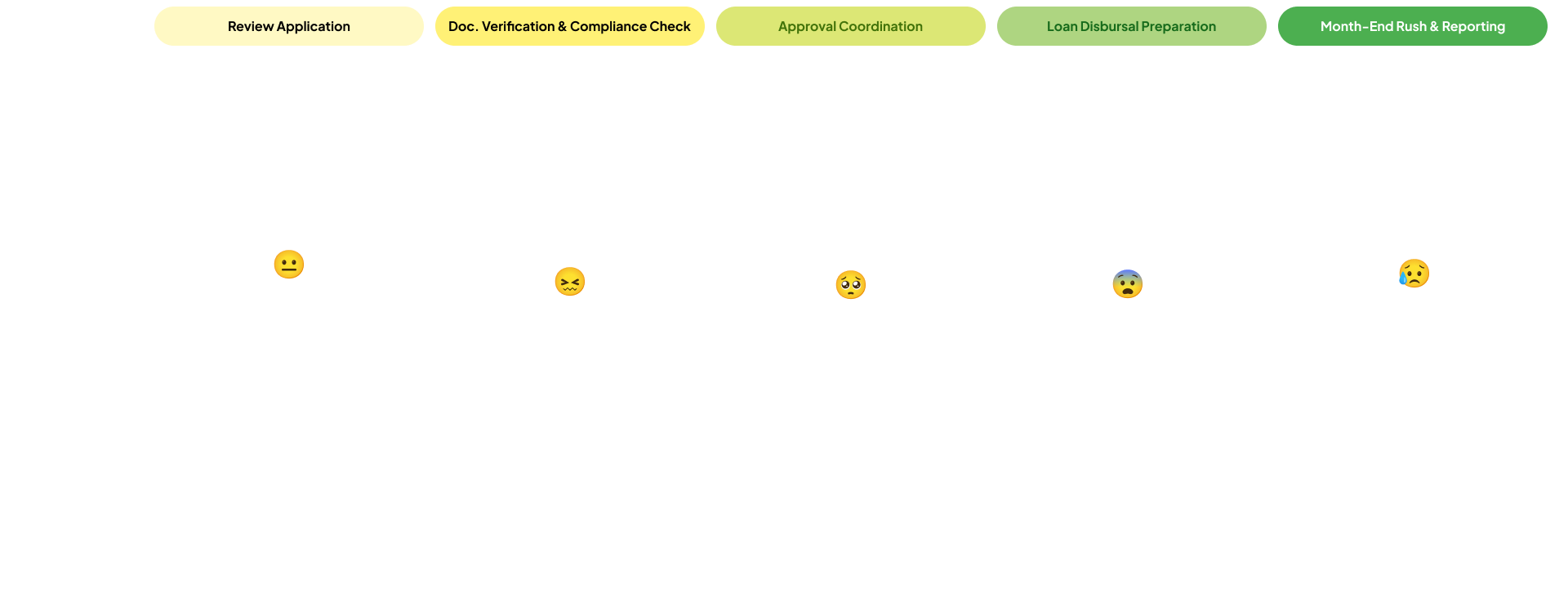

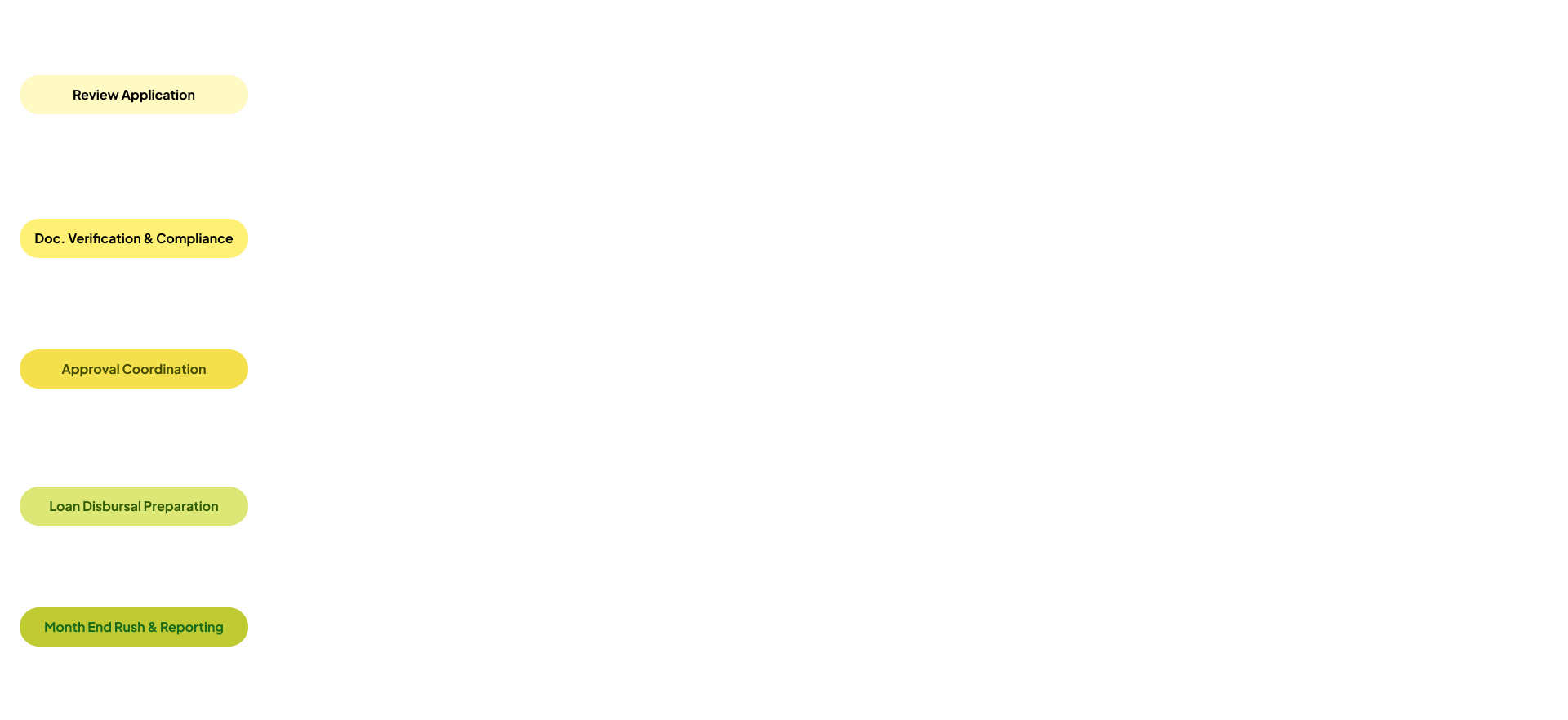

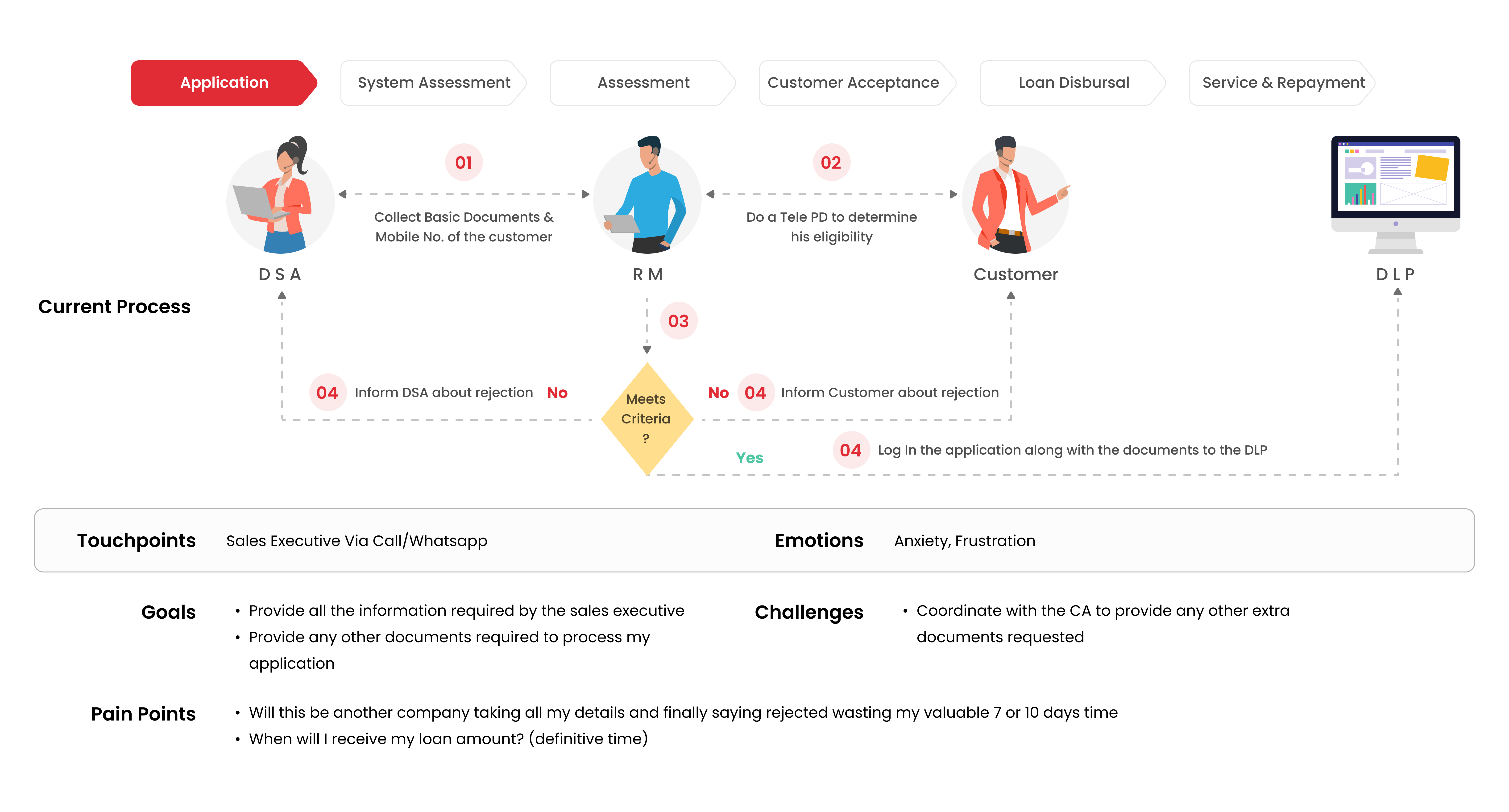

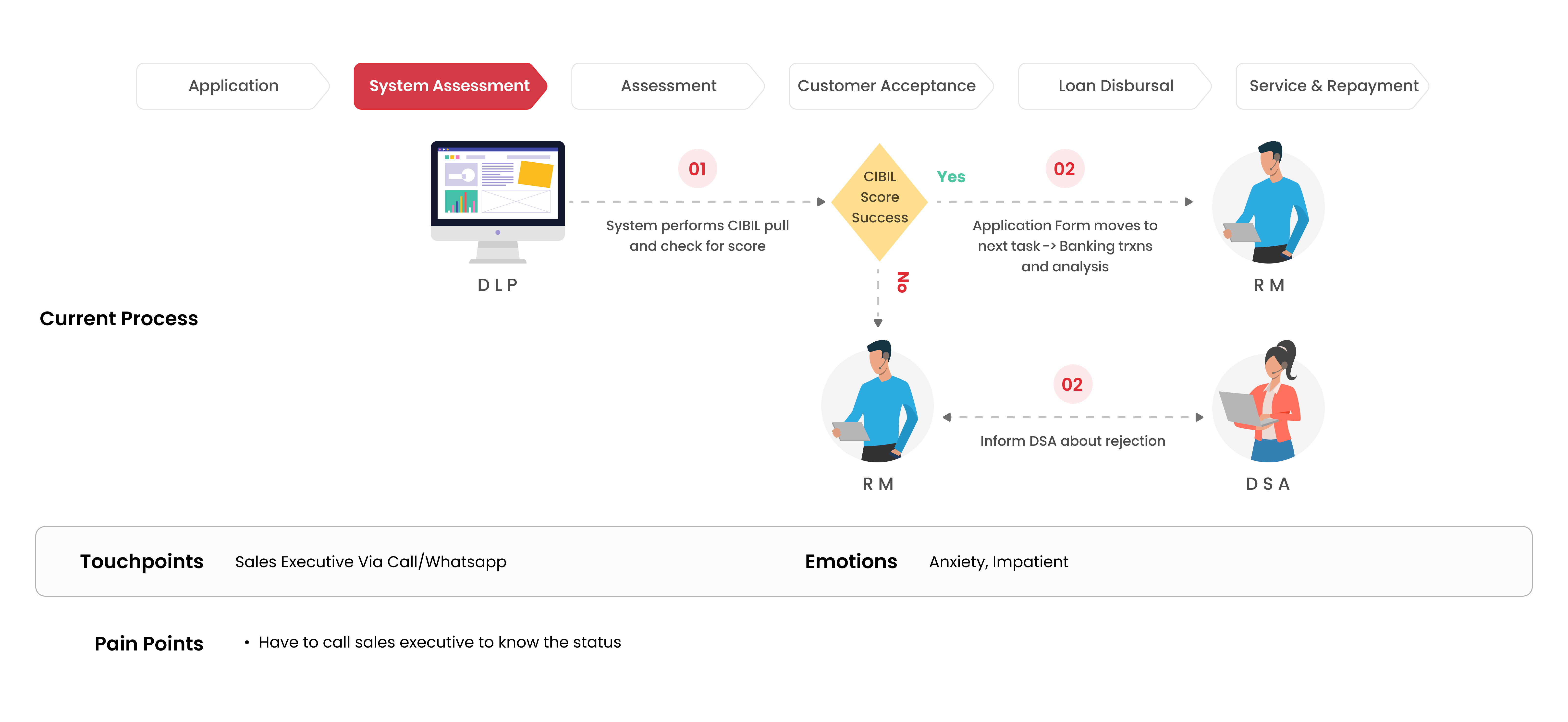

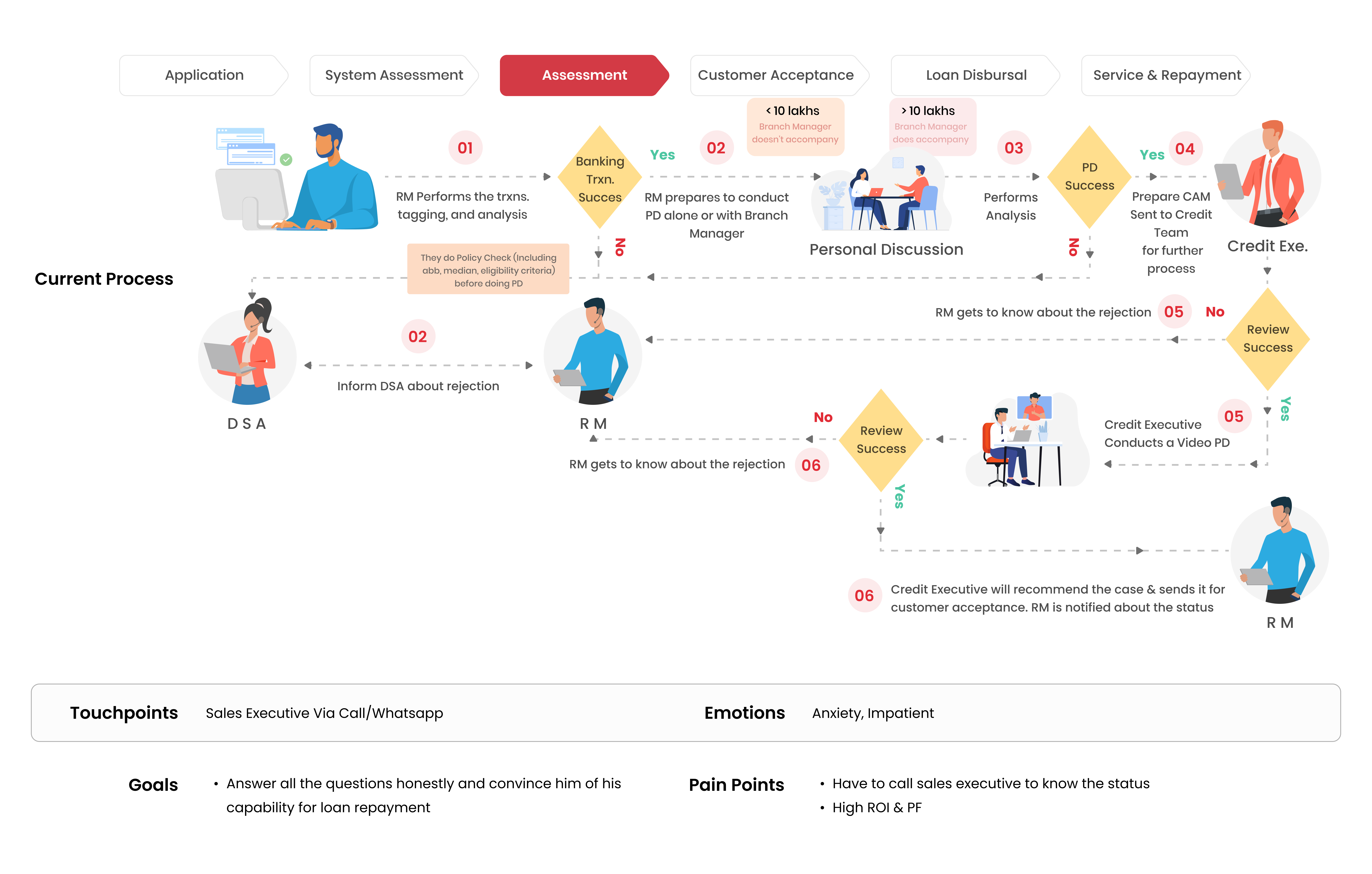

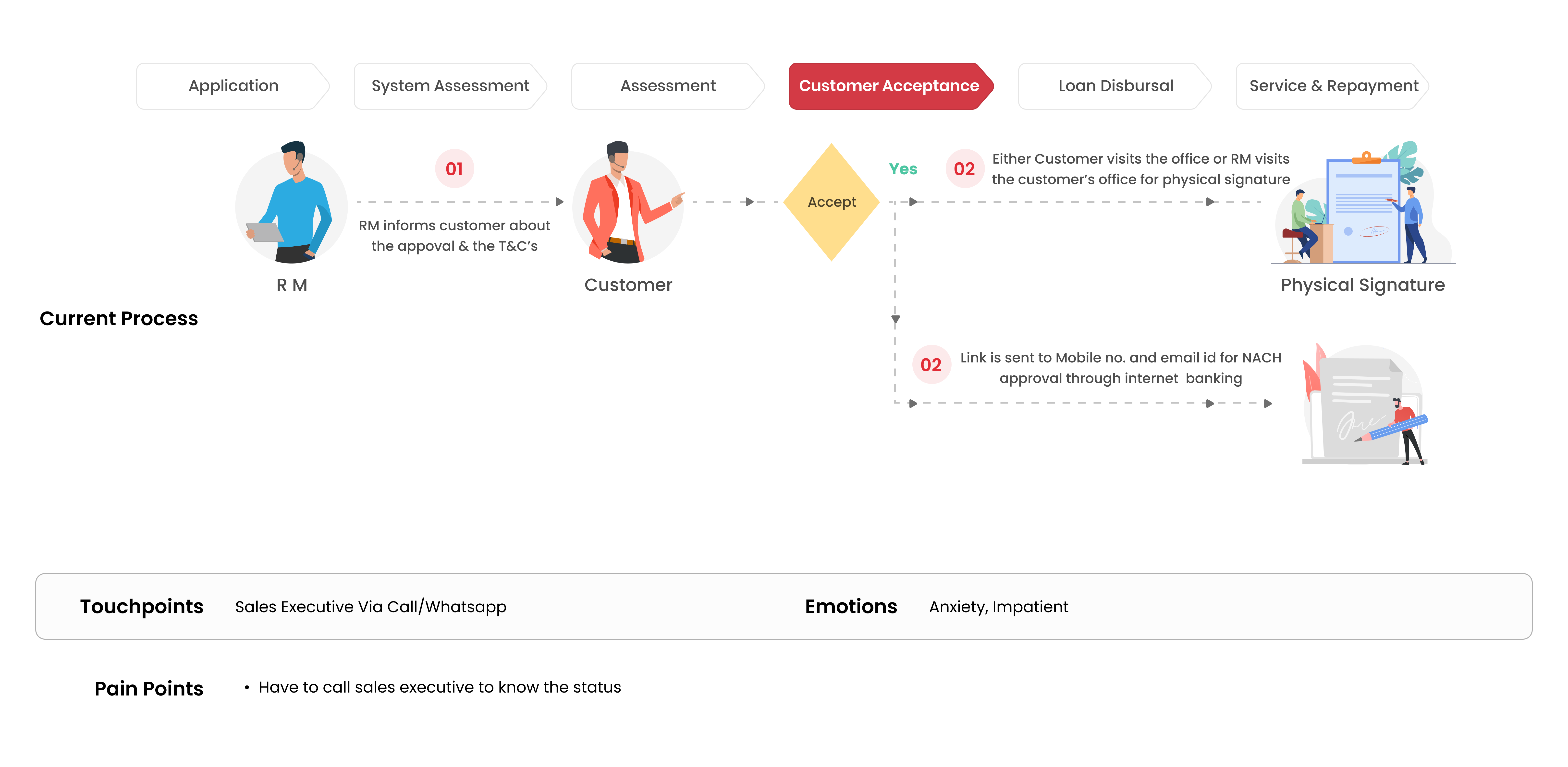

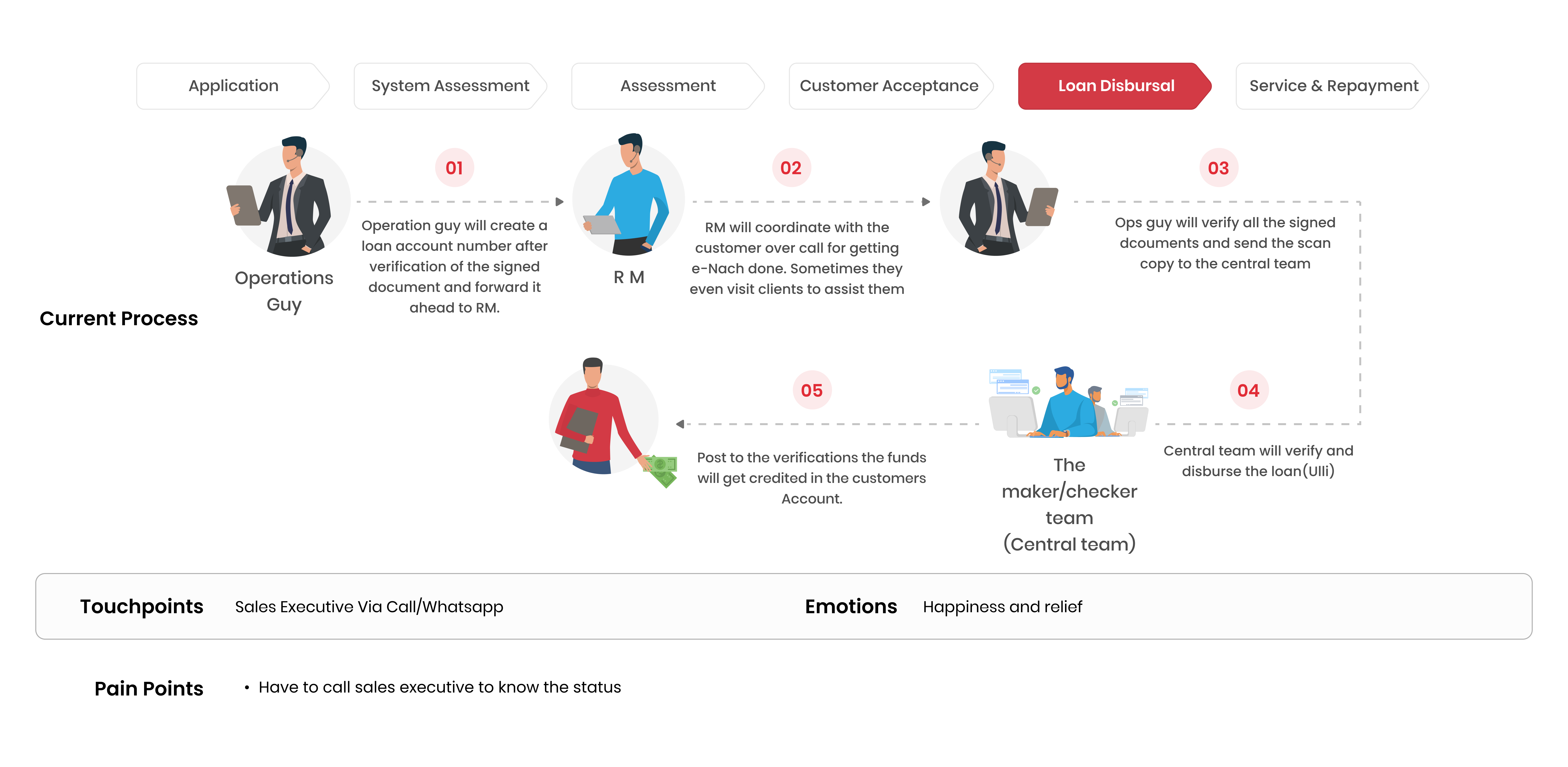

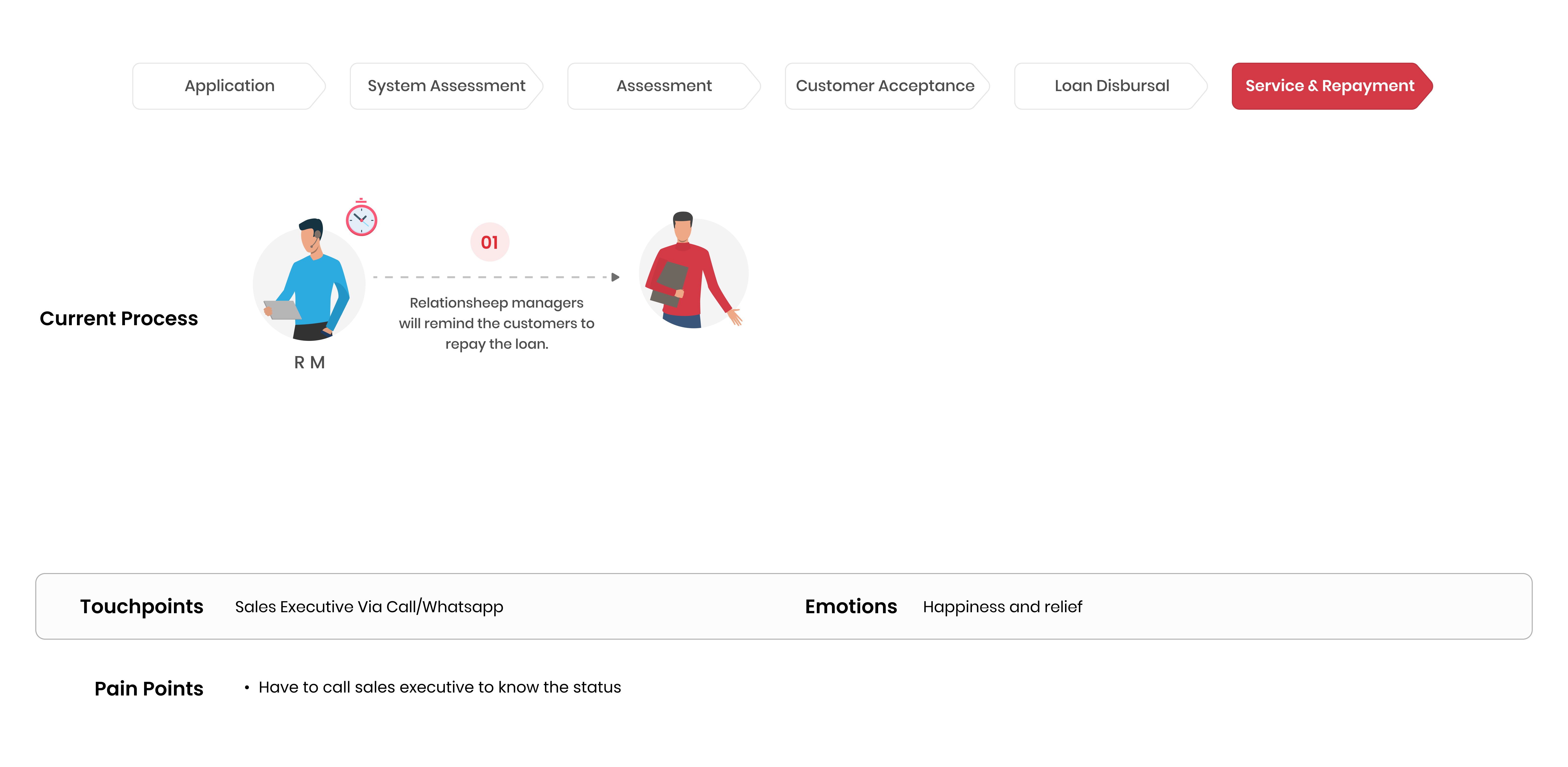

🚶♂️ Ravi's Journey

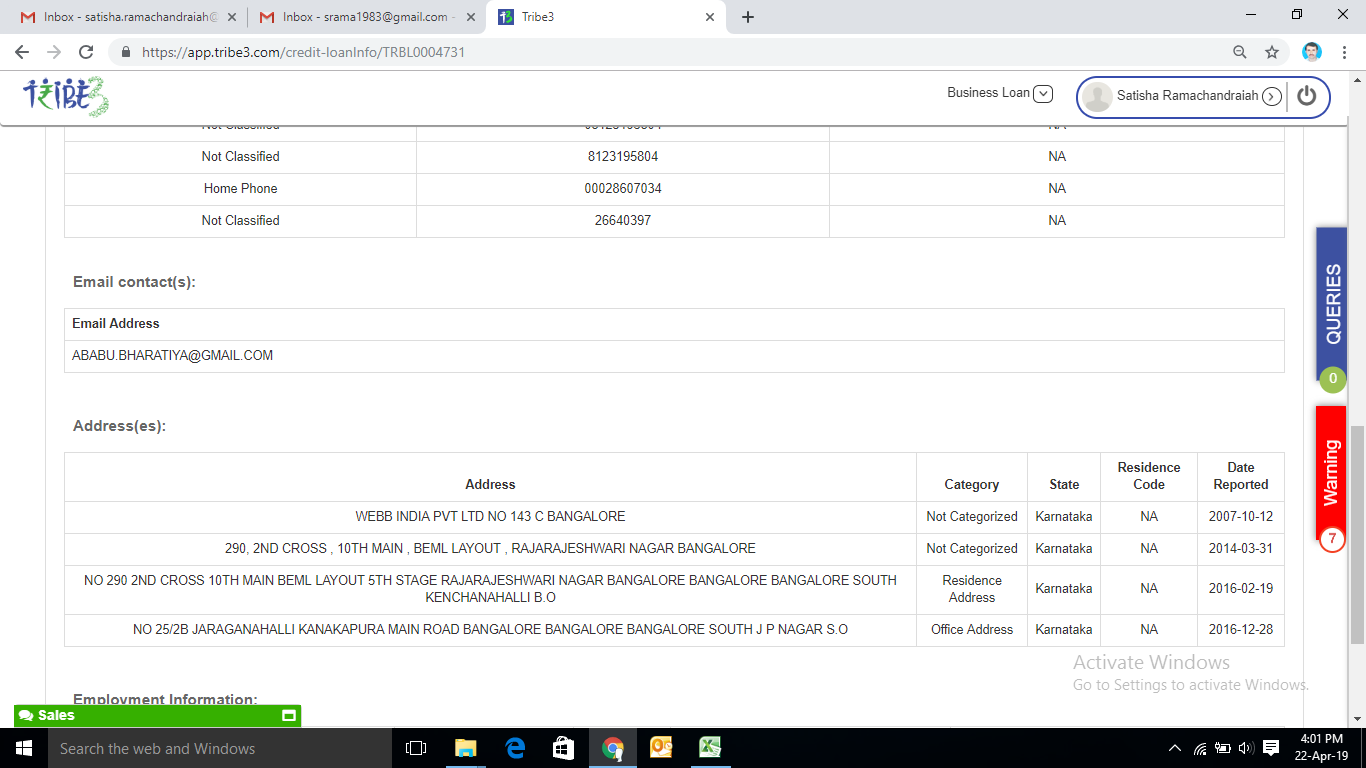

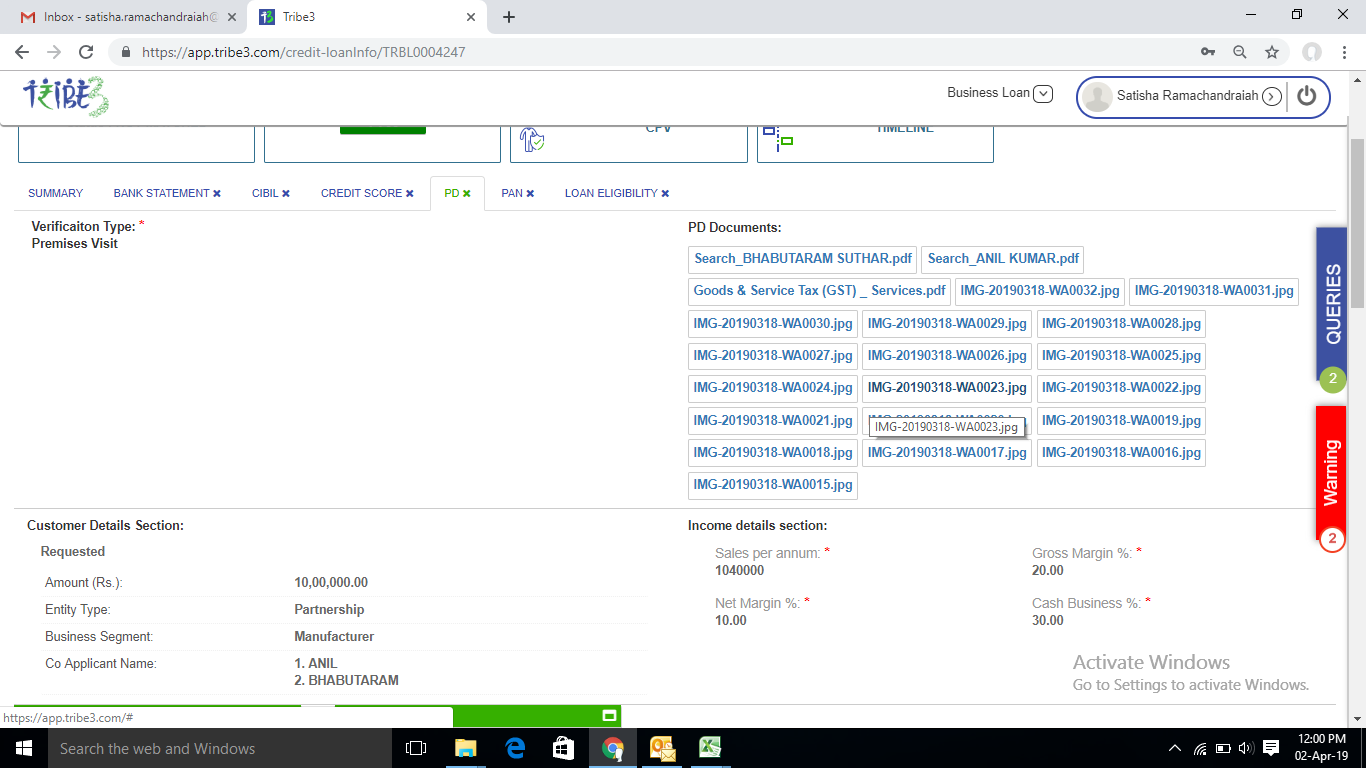

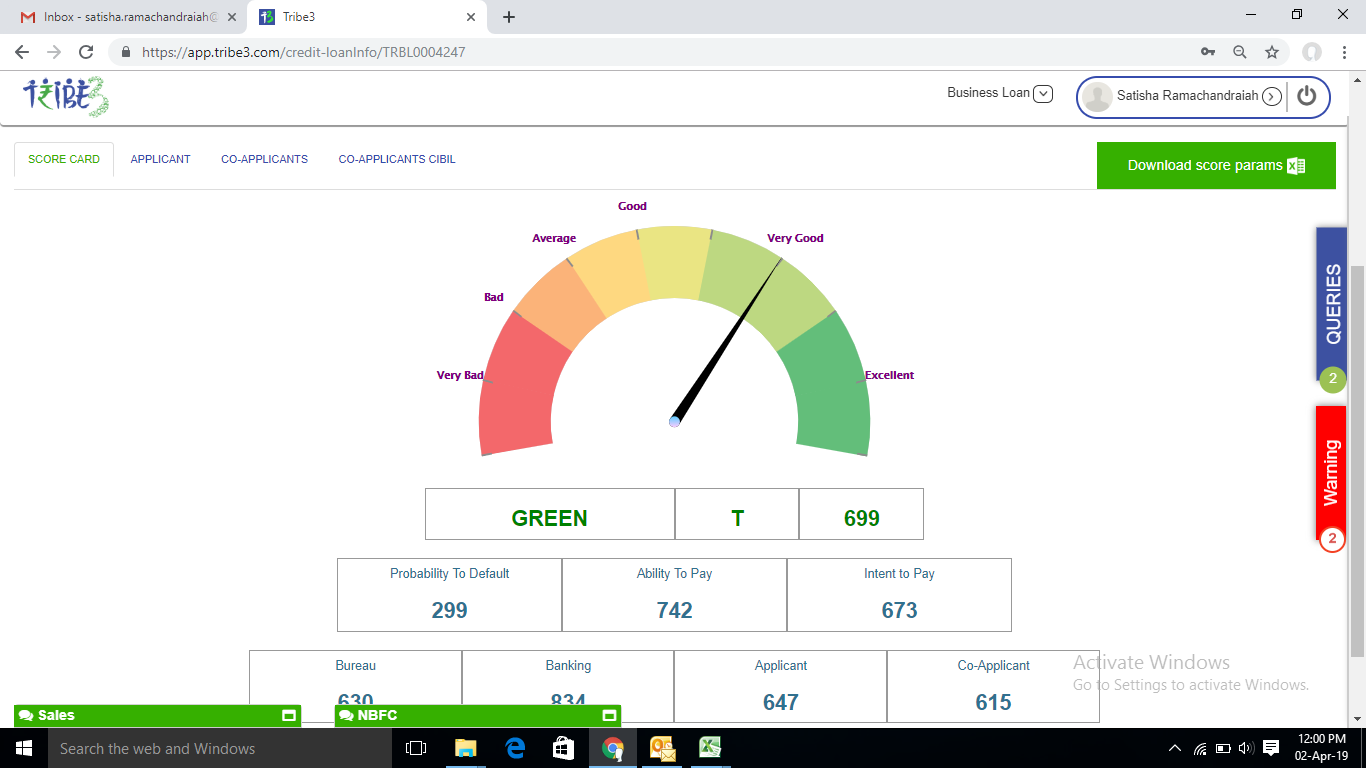

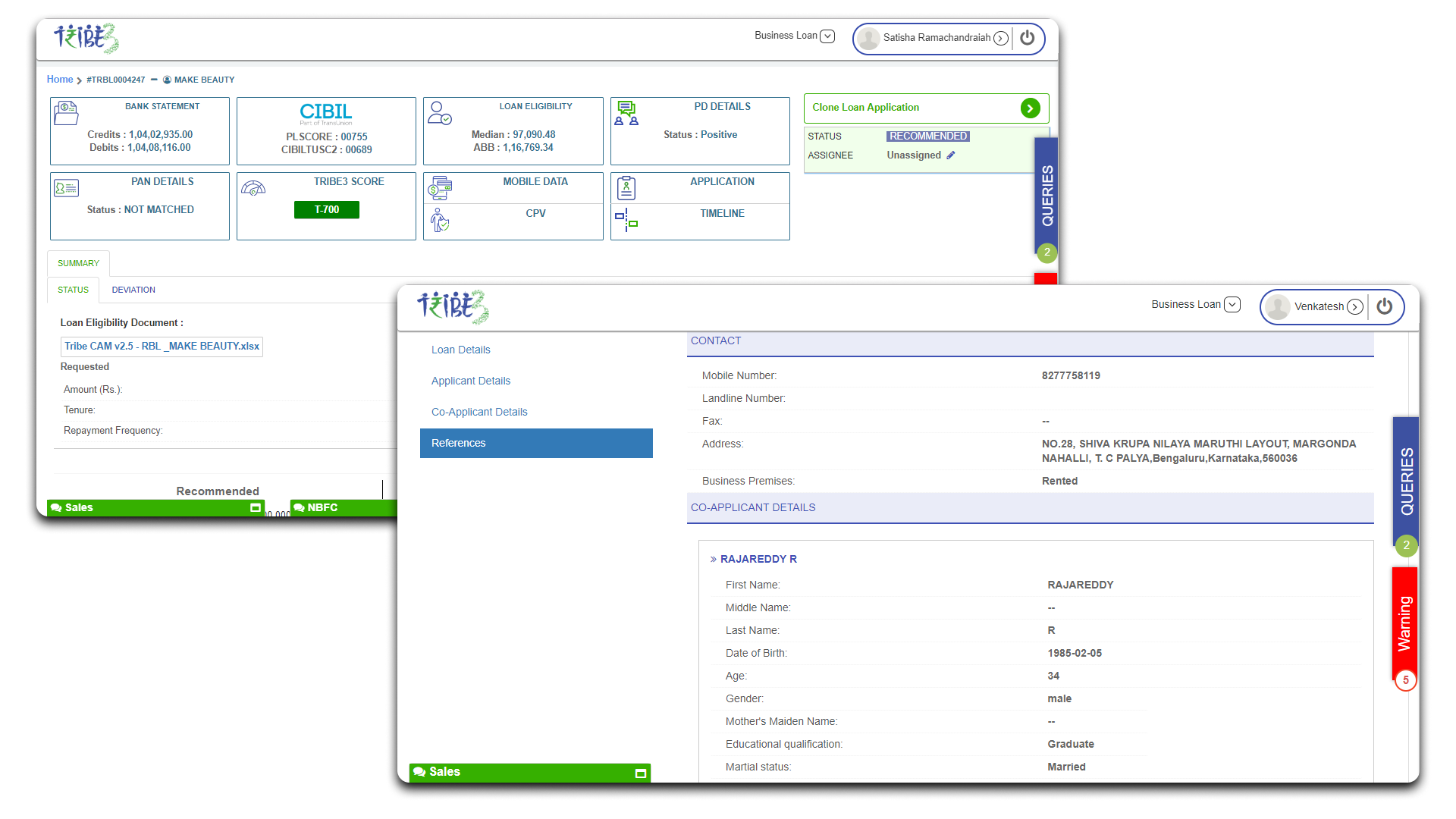

Based on the insights gathered from our research, we created detailed journey maps for each persona, capturing their goals, pain points,

and key interactions across the touchpoints. This helped us visualize the end-to-end experience and identify meaningful opportunities

for design improvement.

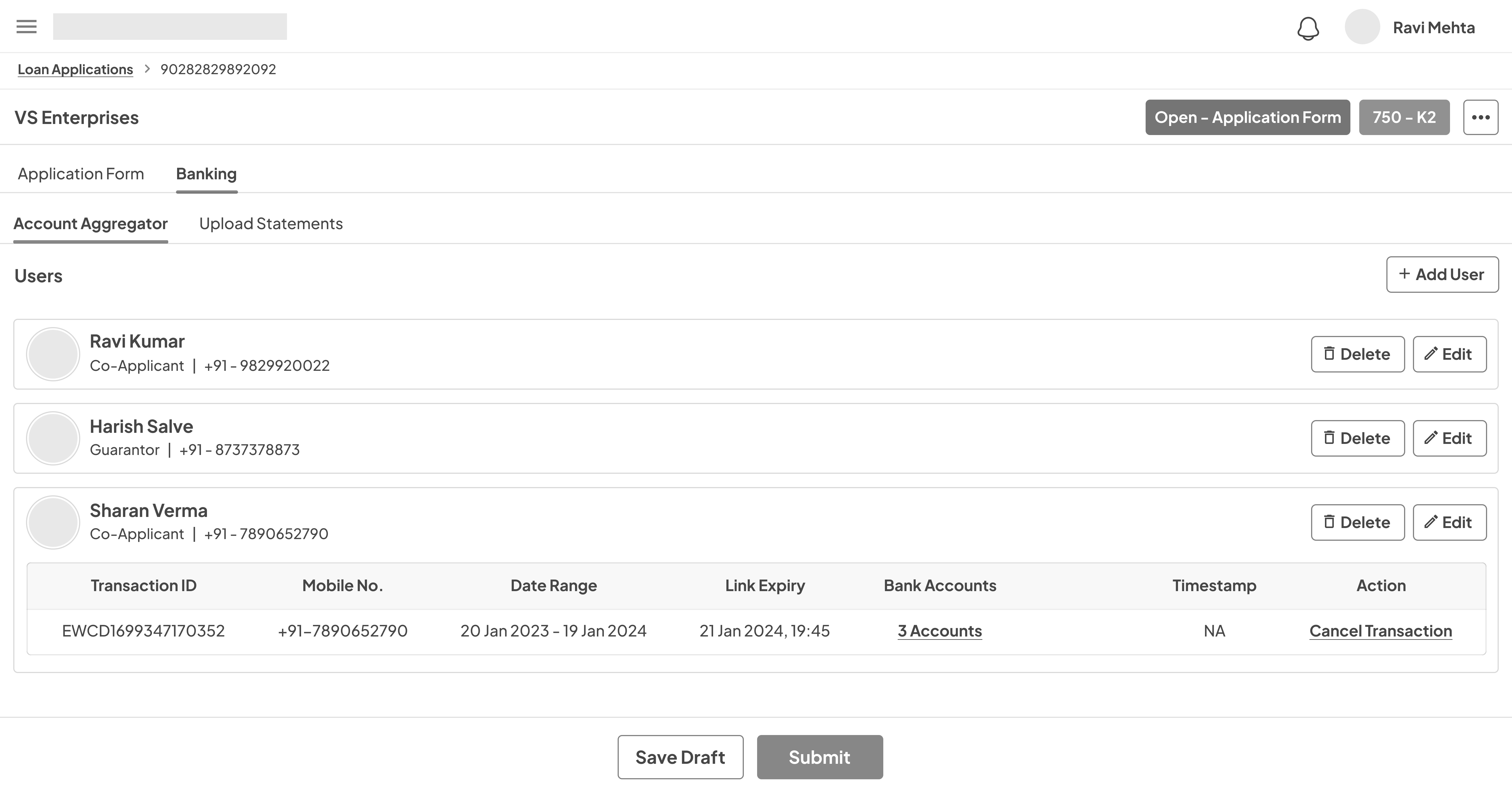

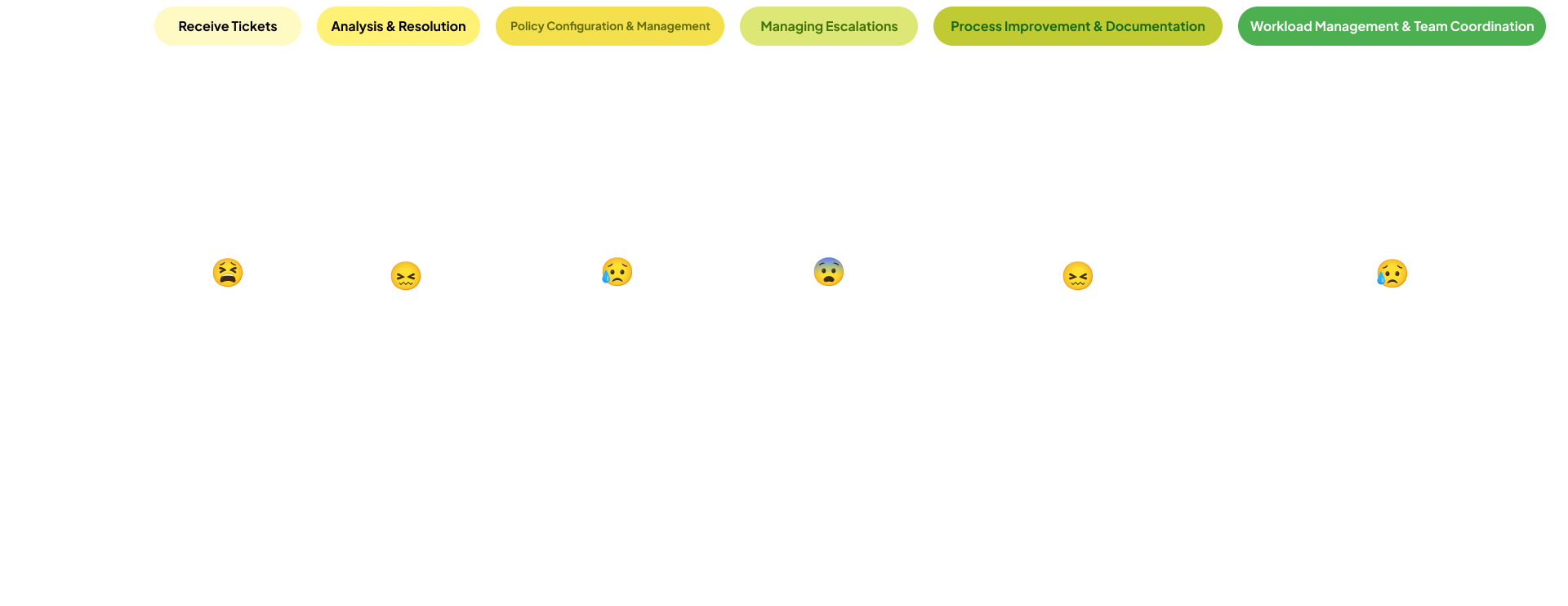

👓 Ravi's Point of View & "How Might We.."

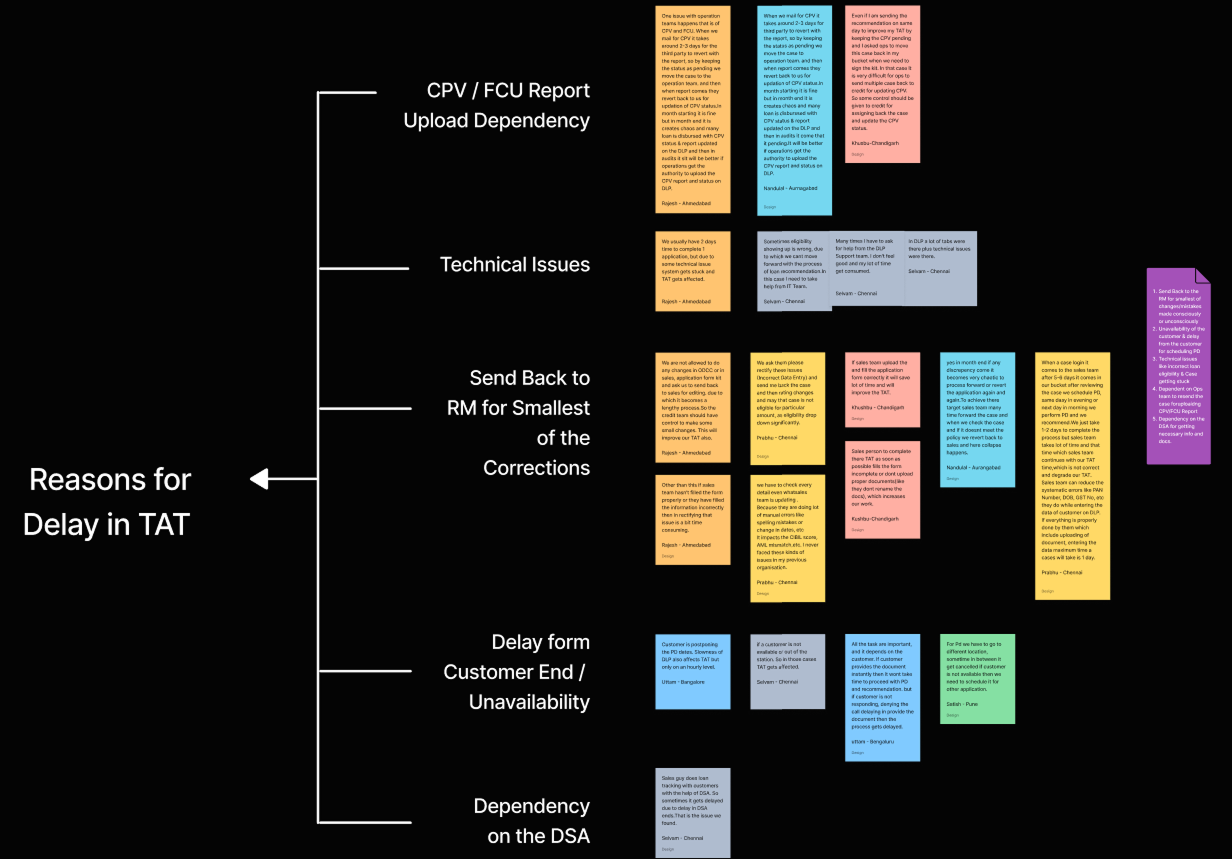

Through immersive field research and user shadowing, we uncovered overlooked pain points by mapping real-world workflows and emotions.

These insights helped us craft clear Point of View statements and translate them into focused "How Might We" questions, guiding purposeful

design.